Canada Gazette, Part I, Volume 151, Number 24: Bank Recapitalization (Bail-in) Conversion Regulations

June 17, 2017

Statutory authorities

Canada Deposit Insurance Corporation Act

Bank Act

Sponsoring department

Department of Finance

REGULATORY IMPACT ANALYSIS STATEMENT

(This statement is not part of the regulations.)

Issues

The Canadian financial system remained resilient throughout the 2008 global financial crisis, with no Canadian bank failures. In fact, Canadian banks were able to maintain their access to debt and equity markets throughout the crisis. Today, they are even stronger and better capitalized.

This experience demonstrated the value of Canada's approach to financial sector regulation and supervision. Nevertheless, the crisis further highlighted that some banks are “systemically important” — so important to the functioning of the financial system and economy that they cannot be wound down under a conventional bankruptcy and liquidation process (should they fail) without imposing unacceptable costs on the economy. These institutions are commonly labelled as “too-big-to-fail.”

Faced with inadequate tools to deal with failed major banks, many authorities in other jurisdictions were forced to rely on taxpayer-funded capital injections to support these institutions in the interests of broader financial and economic stability.

In addition to the direct costs to taxpayers associated with these bailouts, the expectation of a bailout if the bank were to fail gives the banks' managers an incentive to take on excessive risk, as they would receive all of the potential benefits, but bear only some of the potential costs.

The expectation of a bailout also allows systemically important banks to borrow on more favourable terms, as creditors view the bank's debt as implicitly guaranteed by taxpayers. By contrast, small and medium-sized banks do not benefit from this implicit subsidy in the form of lower funding costs, as there is less of an expectation that they would be bailed out should they fail.

Government intervention is needed to address the risks to financial stability, the broader economy, and taxpayers, associated with systemically important banks, as outlined above.

Background

Canada has been an active participant in the G20's financial sector reform agenda aimed at addressing the factors that contributed to the crisis. This includes international efforts to address the potential risks to the financial system and broader economy of institutions perceived as “too-big-to-fail.”

International response to “too-big-to-fail”

Recognizing the cross-border impacts of both financial crises and the market distortions caused by bailouts, G20 members and the Financial Stability Board (see footnote 1) set out a global financial sector reform agenda to (i) reduce the probability of a crisis, and (ii) enhance the capacity to deal with troubled financial institutions in a crisis. Ending “too-big-to-fail” is a key component of this agenda. One of the primary tools for addressing “too-big-to-fail” is bail-in — namely the power for domestic authorities to convert some of a failed bank's debt into equity to recapitalize the bank and help restore it to viability without the use of government bailouts.

Canada's framework for domestic systemically important banks

Consistent with the G20 reform agenda, Canada has taken a number of steps since the financial crisis to strengthen the banking sector and reduce the probability and impact of bank failures. This has included implementing international standards to improve the quantity and quality of banks' capital.

In addition, Canada has been implementing a number of measures aimed specifically at the risks posed by systemically important banks. Canada's six largest banks (see footnote 2) were named as systemically important by the Office of the Superintendent of Financial Institutions (OSFI) in 2013.

A number of elements of this framework have been implemented. These consist of higher capital requirements, enhanced supervision by OSFI and institution-specific recovery plans and resolution plans. Implementation of a bail-in regime is the key outstanding element of the framework.

Bank resolution in Canada

The Canada Deposit Insurance Corporation (CDIC) is Canada's federal deposit insurer and resolution authority for its member institutions. CDIC has a number of resolution tools that can be used to manage the potential failure of a member institution, including a systemically important bank.

CDIC's existing resolution tools include the following:

- Liquidation and reimbursement of insured deposits, whereby the bank is wound up under a court- supervised liquidation and insured deposits are reimbursed to depositors.

- Forced sale, whereby the bank is placed under temporary CDIC control to complete its sale, merger or restructuring. There are the following two types of forced sales:

- Shares and subordinated debt of the bank are transferred to CDIC and it becomes the sole shareholder to facilitate the sale.

- CDIC is appointed receiver to complete a sale of all or some of the bank's assets and/or an assumption of its liabilities.

- Bridge bank, whereby the bank is placed under temporary CDIC control (i.e. CDIC is appointed receiver of the bank) and CDIC transfers certain assets, liabilities (including at a minimum all insured deposits) and critical functions to a bridge bank, which is temporarily owned by CDIC. The bridge bank can operate, with Governor in Council approval, for up to five years before it must be sold or wound up.

Bail-in regime for banks — Legislative framework

To strengthen Canada's bank resolution toolkit, Budget 2016 announced that the Government would implement a bail-in regime for Canada's systemically important banks. The regime would allow authorities to convert shares (e.g. preferred shares) and liabilities (as set out in regulation) of a failing systemically important bank into common shares to recapitalize the bank and allow it to remain open and operating. A legislative framework for the bail-in regime was put in place via amendments to the Bank Act and Canada Deposit Insurance Corporation Act (CDIC Act) as part of Budget Implementation Act, 2016, No. 1 (BIA 1 2016), which received royal assent on June 22, 2016.

Specifically, BIA 1 2016 included amendments to

- permit the Superintendent to formally designate individual banks to which the bail-in regime would apply as “domestic systemically important banks”;

- provide new powers for CDIC to undertake a bail-in by converting eligible shares and liabilities of a non-viable domestic systemically important bank into common shares;

- enhance CDIC's powers that are necessary to resolve a failed bank and to undertake a bail-in conversion — including powers for CDIC to take temporary control or ownership of a failed bank;

- provide for an updated process for bank shareholders and creditors to seek redress (or “compensation”) should they be left worse off as a result of CDIC's actions to resolve a failed bank (including, but not limited to, bail-in) than they would have been if the bank had been liquidated; and

- require domestic systemically important banks to maintain a minimum amount of “total loss absorbing capacity” or “TLAC.” The TLAC requirement is aimed at ensuring that these banks have sufficient equity and loss-absorbing liabilities to withstand severe, but plausible, losses and be restored to viability. It would be met through additional regulatory capital [notably equity and non-viability contingent capital (NVCC) preferred shares and subordinated debt (see footnote 3)] and debt eligible for conversion under the new bail-in conversion power. The TLAC requirement is to be set by the Superintendent.

The legislative framework provides for regulations to be made to set out

- the scope of bank shares and liabilities that would be eligible for bail-in;

- conversion terms if a bail-in were to be executed;

- issuance requirements for bail-in eligible shares and liabilities; and

- an updated compensation process for bank shareholders and creditors (see above) affected by CDIC's actions to resolve a non-viable bank (including, but not limited to, bail-in).

Objectives

The objectives of the bail-in regime, and by extension, the proposed regulations, are to

- preserve financial stability by empowering the Governor in Council and CDIC to quickly restore a failed systemically important bank to viability and allow it to remain open and operating, even where the bank has experienced severe losses;

- reduce government and taxpayer exposure in the unlikely event of a failure of a systemically important bank; and

- reduce the likelihood of a failure of a systemically important bank and increase market discipline by reinforcing that bank shareholders and creditors are responsible for the bank's risks — not taxpayers.

Description

The bail-in regime builds on existing powers that CDIC already has with respect to managing the unlikely scenario of a bank failure.

The bail-in power allows CDIC, if directed to do so by the Governor in Council, to convert some of a failing systemically important bank's debt into common shares in order to recapitalize the bank. This would help restore the bank to viability by reducing the liabilities of the bank and increasing the bank's common equity. Recapitalizing the bank in this way is essential to keeping the bank open and operating as well as providing assurances to the market, customers, credit rating agencies and regulators that the bank will be able to remain viable.

This proposal would implement three new regulations.

- (1) Pursuant to the CDIC Act, the proposed Bank Recapitalization (Bail-in) Conversion Regulations (the Bail-in Scope and Conversion Regulations) set out the scope of liabilities of domestic systemically important banks that would be eligible for a bail-in conversion and conversion terms if a bail-in were to be executed.

- (2) Pursuant to the Bank Act, the proposed Bank Recapitalization (Bail-in) Issuance Regulations (the Bail-in Issuance Regulations) set out requirements that domestic systemically important banks would have to follow when issuing bail-in eligible securities.

- (3) Pursuant to the CDIC Act, the proposed Compensation Regulations set out an updated process for providing compensation to shareholders and creditors of CDIC federal member institutions if they are made worse off as a result of CDIC's actions to resolve the institution (including through bail-in) than they would have been if the institution were liquidated.

The Bail-in Scope and Conversion Regulations and the Bail-in Issuance Regulations apply only to systemically important banks; however, the Compensation Regulations apply to all CDIC federal member institutions (e.g. banks and federal trust companies that take deposits).

How a bail-in would work

The steps for a resolution involving a bail-in are set out in the CDIC Act. As with the use of most of CDIC's other resolution tools, use of the bail-in conversion tool would require a determination by the Superintendent of Financial Institutions (Superintendent) that the bank has ceased, or is about to cease, to be viable, (see footnote 4) and Governor in Council approval, on the recommendation of the Minister of Finance, for CDIC to take temporary control or ownership of the non-viable bank and carry out a bail-in conversion.

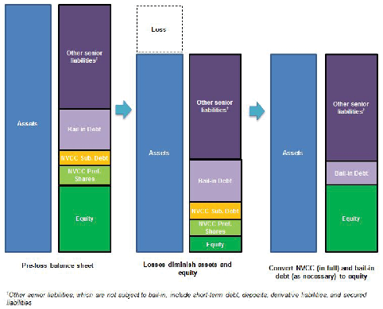

The process would involve CDIC taking temporary control or ownership of the non-viable bank, executing a bail-in conversion (in accordance with the Bail-in Scope and Conversion Regulations) to recapitalize the bank (see Figure 1 below), and undertaking any other restructuring measures necessary to restore the bank to viability (e.g. selling off troubled assets or subsidiaries).

After the completion of the bail-in conversion and other necessary restructuring measures, CDIC would return the bank to private control. The return to private control must happen within one year, although the Governor in Council may extend this time frame up to a maximum total period of five years.

Following the resolution, CDIC would make an offer of compensation to the relevant shareholders and creditors (in accordance with the Compensation Regulations), if they have been made worse off as a result of CDIC's actions than they would have been if the institution had been liquidated. CDIC's offer would be reviewed by a third-party assessor that is appointed by the Governor in Council if the conditions set out in the Regulations are met (i.e. if persons who hold 10% of the value of a given class of shares or debt object to CDIC's offer). Pursuant to the CDIC Act, the assessor's own determination of compensation owed would be final and conclusive. The CDIC Act requires the appointed third-party assessor to be a federal judge.

Figure 1. Illustrative example of impact of bail-in on a bank balance sheet

Bank Recapitalization (Bail-in) Conversion Regulations

The CDIC Act provides that regulations will specify which shares and liabilities issued by systemically important banks will be eligible for conversion under the bail-in power. The CDIC Act also provides that the determination of terms, conditions and timing of a bail-in conversion shall be set by CDIC, subject to any regulations and CDIC by-laws.

Scope

A key objective underlying the proposed scope of application for the bail-in power is to minimize the practical and legal impediments to exercising a bail-in conversion in a timely fashion. It is also aimed at minimizing potential adverse impacts on banks' access to liquidity under stress.

As required by the CDIC Act, the bail-in power would not be retroactive. The proposed Regulations would only apply to instruments that were issued, or amended to increase their principal value or extend their term, after the Regulations come into force.

The proposed Regulations would set a scope for the bail-in power that is consistent with Finance Canada's (the Department) 2014 public consultation paper on a proposed bail-in regime: long-term (400 or more days), unsecured senior debt that is tradable and transferable. These securities are currently issued predominantly to institutional investors such as asset and fund managers.

All newly issued instruments that have these features would be eligible for a bail-in conversion. For the purposes of these Regulations, an instrument is considered tradable and transferable if it has a Committee on Uniform Securities Identification Procedures (CUSIP) number, International Securities Identification Number (ISIN) or other similar identification.

Newly issued preferred shares and subordinated debt would also be eligible for bail-in, if they are not NVCC. However, in practice, banks are not expected to issue any such instruments, as preferred shares and subordinated debt are almost exclusively issued in the form of NVCC in order to have them count towards existing regulatory capital requirements set by OSFI. NVCC instruments are not included in the scope of bail-in given that they are already convertible into common shares pursuant to their contractual terms. (see footnote 5)

The proposed scope does not capture deposits, secured liabilities (e.g. covered bonds), eligible financial contracts (e.g. derivatives) or structured notes. (see footnote 6) As such, these instruments would not be eligible for conversion under bail-in.

The proposed scope would be incorporated by reference in the Bail-in Issuance Regulations, which would be made pursuant to the Bank Act (see below). This is because the requirements set out in those Regulations would apply to all bail-in eligible instruments (i.e. those captured within the proposed scope). In addition, it would allow bail-in eligible instruments to be eligible to meet OSFI's TLAC requirement (provided the instruments meet additional criteria as set by OSFI), which is set out in the Bank Act.

Conversion

In accordance with the CDIC Act, CDIC must set the terms and conditions — including the timing — of a bail-in conversion, subject to any regulations respecting conversion. The proposed Regulations would contain the parameters that CDIC must follow in undertaking a bail-in conversion. These parameters serve to clarify that the purpose of the bail-in is to recapitalize the institution, and to ensure that the relative creditor hierarchy (see footnote 7) is respected (i.e. that holders of more senior instruments should be better off than holders of more junior instruments and holders of equally ranking bail-in instruments should be treated equally).

Specifically, the proposed Regulations provide that a bail-in conversion must meet the following parameters:

- (1) Adequate recapitalization — in carrying out a bail-in, CDIC must take into consideration the requirement in the Bank Act for banks to maintain adequate capital.

- (2) Order of conversion — bail-in eligible instruments can only be converted after all subordinate ranking bail-in eligible instruments and NVCC have been converted.

- (3) Treatment of equally ranking instruments — equally ranking bail-in eligible instruments must be converted in the same proportion (pro rata) and receive the same number of common shares per dollar of the claim that is converted.

- (4) Relative creditor hierarchy — holders of bail-in eligible instruments must receive more common shares per dollar of the claim that is converted than holders of subordinate ranking bail-in eligible instruments and NVCC that have been converted.

Through existing powers, the Governor in Council and CDIC would also be able to ensure that senior bail-in debt holders are better off than holders of legacy capital instruments — i.e. those that are not NVCC and which would not be eligible for conversion under the bail-in power. For example, resolution actions could result in holders of legacy capital instruments incurring losses where those instruments are vested in CDIC by the Governor in Council, pursuant to paragraph 39.13(1)(a) of the CDIC Act.

Bank Recapitalization (Bail-in) Issuance Regulations

The Bank Act provides that the Governor in Council may make regulations respecting the conditions that systemically important banks must meet in issuing or amending bail-in eligible shares and liabilities.

The proposed Regulations seek to achieve the following two key outcomes:

- (1) CDIC's bail-in conversion powers can be exercised and are enforceable with respect to all bail-in eligible shares and liabilities, even where these shares and liabilities are governed by foreign law.

- (2) Investors have clarity as to which bank issuances are eligible for CDIC's bail-in conversion powers.

To facilitate enforceability of the bail-in power (especially in a cross-border context), the proposed Regulations would require that shares and liabilities within the scope of bail-in indicate in their contractual terms that the holder of the instrument is bound by the application of the CDIC Act, including the conversion of the instrument into common shares under the bail-in power. The proposed Regulations would require that these new contractual terms be governed by Canadian law, even where the rest of the contract is governed by foreign law.

Additionally, so that investors have clarity as to which bank issuances are eligible for a bail-in conversion, the proposed Regulations would require disclosure to investors that an instrument is eligible for a bail-in conversion in the prospectus or other relevant offering or disclosure document.

Failure to meet these requirements for a given issuance would not exempt that issuance from being eligible for bail-in.

Compensation Regulations

The existing CDIC Act includes provisions setting out a process for providing shareholders and creditors of CDIC federal member institutions with compensation from CDIC following a resolution process for the institution. These compensation provisions apply in respect of all of CDIC's federal member institutions and most resolution tools (i.e. with the exception of a standard liquidation and reimbursement of insured deposits).

The compensation process is based on a test of whether or not consideration received by shareholders and creditors in respect of a transaction undertaken by CDIC (e.g. the sale of the bank — or some or all of its assets — to a third party) was reasonable in the circumstances, and the CDIC Act sets out detailed procedural requirements.

The legislative amendments included in the BIA 1 2016 revised this compensation process by setting out a different test for entitlement to compensation consistent with international standards and best practices, and moving most elements of the process from the legislation into regulations and/or CDIC by-laws, for greater flexibility. The new compensation test provided for in the legislation is whether the relevant shareholders and creditors have been made worse off as a result of CDIC's actions than they would have been if the institution had been liquidated. These amendments would be brought into force concurrently with the proposed Regulations.

The proposed Regulations would establish a compensation process with the following features, many of which build on or adapt existing legislative provisions in sections 39.23 to 39.37 of the CDIC Act (i.e. those that would be repealed and replaced, through the coming into force of amendments included in the BIA 1 2016, with provisions setting out the new compensation test and associated Governor in Council powers to make regulations and CDIC powers to make by-laws as described above).

Persons entitled to compensation

“Prescribed persons” entitled to compensation would be persons who hold the following claims in the institution at the time of entry into resolution:

- (a) shares of the institution;

- (b) subordinated debt instruments that were vested in CDIC at the time of entry into resolution;

- (c) liabilities that were subsequently converted into common shares pursuant to their contractual terms and conditions (e.g. NVCC);

- (d) liabilities that were subsequently converted into common shares pursuant to the bail-in power;

- (e) any liability of the institution, if the institution was wound up at the end of the resolution process; and

- (f) any liability of the institution that was assumed by either a CDIC-owned workout company (see footnote 8) or bridge institution, which was subsequently liquidated or wound up.

A general exception to this list of prescribed persons would be individuals who hold liabilities of the institution at the time of entry into resolution that were subsequently assumed by a solvent third party or a bridge institution in the context of the resolution. These individuals would not be entitled to compensation. This reflects the principle that creditors of the institution should not be entitled to compensation if, following the resolution, they continue to have a claim of the same value and type against a solvent going-concern entity (e.g. the original institution that has been restored to viability, a third party or a bridge institution). Similarly, individuals who hold liabilities of the institution at the time of entry into resolution would not be entitled to compensation if the amounts owing under the liability's terms are subsequently paid off in full (i.e. if they were made whole).

Transferability of entitlement to compensation

The right to compensation would be a personal right of the above-listed prescribed persons — it would not be transferable. This is intended to reduce the potential role of speculators in the compensation process, support administrative simplicity of the process, and ensure greater alignment between those entitled to compensation and the shareholders and creditors actually affected by CDIC's resolution actions.

Amount of compensation

CDIC would make an offer of compensation to prescribed persons based on the difference between an estimate of what they would have received if the institution had been wound up (the “liquidation value”) and an estimate of the value they received (or will receive) through the resolution process (the “resolution value”). If the resolution value was the same as, or greater than, the liquidation value, no compensation would be owed.

Compensation would not be determined on the basis of specific individual circumstances of prescribed persons (e.g. gains or losses from trading in the banks' securities during the resolution period), but rather the treatment of their claims. More specifically, CDIC must make the same offer of compensation to prescribed persons who held shares or liabilities of the same class (in proportion to their claim). Shares or liabilities would be deemed to be in the same class if they would rank equally in the event of a winding up of the institution and received equivalent treatment in the resolution.

The proposed Regulations would set out certain assumptions that CDIC must take into account when determining the offer of compensation. For example, in estimating the liquidation value of shares or liabilities, CDIC would be required to assume that in the counterfactual scenario of the bank being liquidated, the bank would not have received any financial assistance or support from CDIC, the Bank of Canada, the Government of Canada or a province in the process.

It is expected that CDIC's resolution actions would preserve value in the institution relative to a liquidation, such that in most cases, little or no compensation would be owed to prescribed persons. (see footnote 9)

Offer of compensation

CDIC would provide a notice to prescribed persons with an offer of compensation within a reasonable period of time following the completion of the resolution process. No fixed time limit is proposed given the significant expected differences in time required by CDIC to prepare offers in different circumstances (e.g. depending on the size and complexity of the institution, the resolution strategy or tool applied to the institution, and the number of prescribed persons involved). Prescribed persons would have 45 days to notify CDIC of their acceptance of, or objection to, the offer once received. Failure to notify CDIC would be deemed as an acceptance of the offer.

Appointment of assessor

The proposed Regulations would specify the conditions under which the Governor in Council is required to appoint a judge as an assessor to review CDIC's determination of compensation for prescribed persons. It is proposed that the threshold for requiring an assessor to be appointed is if persons who held 10% of the value of debt or 10% of the shares of a given class object to CDIC's offer. Only prescribed persons who objected to CDIC's offer and were part of a class that met the 10%threshold would have their compensation determined by the assessor. Those who accepted CDIC's offer would receive the amount set out in the offer.

In reviewing CDIC's offer of compensation and determining the amount of compensation owed, the assessor would be required to consider whether CDIC's offer was reasonable and consider the same factors as those that CDIC was required to apply when making its initial determination of compensation. Pursuant to the CDIC Act, the assessor's own determination of compensation owed would be final and conclusive.

Payment of compensation

CDIC would be required to pay prescribed persons their entitled compensation within 90 days of the expiry of CDIC's offer of compensation (if the offer was accepted) or the final determination of the assessor, as the case may be. Compensation payments would come from CDIC's funds. CDIC is funded through premiums assessed against its member institutions.

OSFI orders and guidance and CDIC by-laws

In addition to the proposed regulations, OSFI is expected to issue, pursuant to its powers and obligations under the Bank Act, orders and guidance necessary for implementation of the bail-in regime. This includes orders formally designating Canada's six largest banks as systemically important banks and setting the TLAC requirement (see above). In addition, OSFI is expected to specify the transition period before banks are required to meet the TLAC requirement and eligibility criteria for bail-in instruments in order to count towards that requirement.

After the Regulations are in place, CDIC is expected to develop by-laws pursuant to its power to make by-laws in the CDIC Act, as necessary to set any outstanding administrative aspects related to bail-in or the compensation process. For example, with respect to compensation, a by-law could set out procedural elements such as the process for identifying persons entitled to compensation and submitting claims.

“One-for-One” Rule

The “One-for-One” Rule does not apply to this proposal, as the three proposed regulations do not impose any new administrative burden that financial institutions would not otherwise already face as part of their usual business practices.

Small business lens

The small business lens does not apply to this proposal, as no new costs would be imposed on small businesses.

Consultation

The Department has conducted extensive consultations on the bail-in regime, including through the release of a 2014 public consultation paper and more recent targeted consultations on the proposed regulations.

2014 public consultations on proposed bail-in regime

In August 2014, the Department released a consultation paper on its website setting out a proposed design for the bail-in regime. During the six-week comment period, the Department received 14 written submissions from industry associations, investors, and academics. The Department also met with banks, investors, market analysts, credit rating agencies, and legal experts to discuss the proposed approach for the regime and solicit feedback. Given the largely positive stakeholder feedback received, the proposed design of the regime is broadly consistent with the design in the consultation paper, with a few exceptions as described below.

Stakeholders were generally supportive of the proposed narrow scope of application for the regime, including the proposal to apply bail-in only to newly issued instruments (rather than retroactively) as well as the proposed exclusion of short-term liabilities as a means of preserving banks' access to liquidity during periods of stress. Several stakeholders suggested that the criteria that an instrument be “tradable and transferable” in order to be eligible for bail-in be defined in terms of whether the instrument has a Committee on Uniform Securities Identification Procedures (CUSIP) number, International Securities Identification Number (ISIN) or other similar identification. This suggested approach is included in the proposed regulations.

The 2014 consultation paper proposed a predetermined formula for calculating the number of common shares received by converted bail-in debtholders — namely, a fixed multiple of the conversion rate of NVCC. Investors were generally supportive of this approach and the added clarity it would provide to bail-in debtholders in terms of their expected treatment in a bail-in scenario. However, some stakeholders, including the systemically important banks, raised concerns that the approach could unduly limit CDIC's flexibility to set the terms of a bail-in conversion. The banks and some investors also raised concerns that the bail-in regime, and the proposal for a fixed conversion multiplier in particular, could create the potential for arbitrage trading (i.e. buying debt of the failing bank and short-selling their shares) and associated downward pressure on troubled banks' equity prices.

The proposed Bail-in Scope and Conversion Regulations do not include a fixed conversion multiplier. Instead, they would provide CDIC with discretion to determine the conversion rate within the parameters set out in the proposed Regulations. This discretion is intended to (i) provide flexibility for CDIC to set appropriate conversion terms based on the circumstances, (ii) mitigate concerns related to arbitrage trading, and (iii) be more consistent with approaches to bail-in taken in other jurisdictions (e.g. the United States, Switzerland and the European Union).

Budget 2016 and introduction of legislative framework

Stakeholder reactions (e.g. banks, investors and market analysts) were generally positive to the Government of Canada's commitment in Budget 2016 to implement the bail-in regime and subsequent introduction of the legislative framework for the regime through the BIA 1 2016. Some Canadians, senators and members of Parliament raised concerns about whether consumer deposits would be eligible for conversion into common shares under the bail-in regime. The Government has indicated that deposits would not be eligible for bail-in, and the proposed regulations are consistent with that position.

Targeted consultations on proposed regulations

Between September 2016 and February 2017, following the adoption of the legislative framework for the regime (i.e. royal assent of the BIA 1 2016), the Department consulted extensively with affected banks, legal experts, restructuring experts, investors, market analysts, and industry associations on the development of the proposed regulations. These consultations consisted of meetings with stakeholders, though five written submissions were also received. Stakeholders were generally supportive of the proposed approach taken for the three Regulations and did not have any significant objections, although there were some areas where stakeholder views differed.

On conversion terms, stakeholders were generally supportive of the proposed approach. Investors that had supported the proposal in the Department's 2014 public consultation paper for a fixed conversion multiplier (see above) generally acknowledged the importance of ensuring consistency between Canada's bail-in regime and the approaches taken in other jurisdictions by giving CDIC the flexibility to set the conversion rate based on the circumstances at the time of the resolution.

Investors called for greater clarity on the treatment of legacy, non-NVCC instruments in a bail-in resolution. However, given that legacy capital instruments would not be eligible for bail-in, the Department is of the view that the proposed regulations, which pertain to the exercise of the bail-in power, are not the appropriate vehicle for providing such clarity. The potential treatment of legacy capital instruments in a resolution is discussed in further detail above [see the “Description” section, Bank Recapitalization (Bail-in) Conversion Regulations].

In addition, some investors called for a stronger signal or explicit requirement that senior creditors would receive significantly better conversion terms than junior creditors in a bail-in. However, the Department is of the view that CDIC should have the flexibility to set conversion terms that are appropriate in the circumstances of a particular resolution.

On issuance requirements, stakeholders were broadly supportive of the proposed approach.

On the compensation process, stakeholders were supportive of the range of shareholders and creditors that could be entitled to compensation and the parameters guiding CDIC's offer of the amount of compensation owed. In general, stakeholders recognized that this process is unique, such that authorities have a fair degree of flexibility in setting out its design, provided it is broadly fair.

However, differing views were expressed on certain design elements of the compensation process. For example, most legal experts and restructuring practitioners supported having the entitlement to compensation be a personal and non-transferable entitlement, in order to minimize complexity and deter speculators from buying up these entitlements. The proposed regulations reflect this approach. However, some investors argued in favour of being able to freely sell this entitlement so they can completely exit their position in the failed bank, including any obligations on their part to follow the resolution and related compensation process.

Stakeholders were generally comfortable with the proposed criteria for the appointment of an assessor (i.e. where 10% of a given class of shareholders or creditors reject CDIC's offer of compensation). However, some legal experts suggested that the Department consider removing or reducing the threshold of 10%, to allow even a single creditor to have their compensation determined by an assessor if they wished — on the grounds that this would be perceived as a fairer and more open process. Others suggested that there should be a higher threshold in order to deter speculators (even at the potential expense of the perceived fairness and openness of the process). The proposed regulations maintain the 10% threshold based on the position that this would appropriately balance fairness of the process with deterrence of speculators.

Rationale

Budget 2016 announced that the Government would implement a bail-in regime for Canada's systemically important banks, and a legislative framework for the regime was put in place via amendments made through the BIA 1 2016. Adoption of the proposed regulations is necessary for the full implementation of the regime.

Implementation of the bail-in regime would also be consistent with international standards and best practices. Specifically, bail-in is an important component of the Financial Stability Board's Key Attributes of Effective Resolution Regimes for Financial Institutions, which document was endorsed by G20 leaders in November 2011 as part of the G20's broader financial sector reform agenda.

In order to bolster the effectiveness of bail-in powers, the G20 endorsed the Financial Stability Board's minimum TLAC requirement for global systemically important banks (G-SIBs). These are the banks whose failure would have the greatest impact on the global financial system and economy. G-SIBs will be able to meet the minimum requirement with regulatory capital or debt that can be converted into equity through bail-in powers, provided they meet certain additional criteria. (see footnote 10) Canada does not currently have any G-SIBs; however, the Canadian bail-in regime has nevertheless been designed in order to be compliant with international TLAC standards. This would facilitate meeting international G-SIB standards in the event that a Canadian bank were to be designated as a G-SIB.

Full implementation of the bail-in regime, including adoption of the proposed regulations, is expected to yield a number of benefits.

- (1) Enhanced financial stability: the bail-in regime is expected to enhance financial stability in the unlikely event of the failure of a systemically important bank by strengthening the ability of the Governor in Council and CDIC to restore the bank to viability and allow it to continue to provide critical services. This would minimize disruptions for bank depositors, customers and counterparties (see footnote 11) in a crisis.

- (2) Reduction in government exposure: the bail-in regime is expected to reduce the exposure of the Government of Canada (and, by extension, of taxpayers) in the unlikely event of a failure of a systemically important bank, by strengthening authorities' ability to ensure that shareholders and creditors are responsible for bearing the bank's losses.

- (3) Enhanced incentives for appropriate risk taking: the bail-in regime is expected to reduce the expectation on the part of bank investors and creditors that the Government would bail out systemically important banks should they fail, thereby shielding them from absorbing losses. This would strengthen the incentive for shareholders and creditors to monitor the risks of the bank, which would in turn reduce the likelihood of failure of the bank.

- (4) More level playing field within the banking sector: the bail-in regime is expected to result in a more level playing field between systemically important banks and small and medium-sized banks, by reducing the existing implicit subsidy to systemically important banks' funding costs. This implicit subsidy stems from the market expectation of a bailout for systemically important banks, which allows them to borrow on more favourable terms (see below).

Implementation of the bail-in regime is not expected to result in significant changes to the funding structures of systemically important banks. Banks are expected to be able to meet OSFI's legislated TLAC requirement primarily by replacing existing long-term senior debt securities, as they mature, with new debt securities that are eligible for bail-in.

Implementation of the bail-in regime is expected to result in higher funding costs for systemically important banks by reducing the implicit subsidy associated with bank creditors' expectation that they would not suffer losses in the event of a failure (i.e. the expectation of a government bailout). Creditors would no longer expect taxpayers to bear losses instead of them, and so would perceive lending to banks as riskier relative to the status quo. They would therefore require banks to pay higher interest rates on long-term senior debt eligible for bail-in, relative to the interest rates paid on existing equivalent senior debt securities.

The key driver of this cost increase is the legislated TLAC requirement, which will require systemically important banks to issue a minimum amount of additional regulatory capital or bail-in debt (i.e. instruments that do not benefit from the implicit subsidy and are thus more expensive to issue). The proposed regulations do not create a requirement for banks to issue debt that is subject to bail-in.

The overall size (in dollar terms) of the implicit subsidy is related to the size of the losses investors expect they would be shielded from by a government bailout. Since the objective of the TLAC requirement is to ensure that systemically important banks can withstand severe, but plausible, losses, the requirement is expected to result in the removal of most of the implicit subsidy.

As the implicit subsidy cannot readily be observed or estimated, and is generally assumed to fluctuate based on financial market conditions, (see footnote 12) precise estimates of the impact of the bail-in regime on banks' funding costs are inherently challenging. In addition, the extent to which banks will be willing or able to adjust their funding structures to minimize the cost impacts of the bail-in regime is uncertain and will also depend on financial market conditions. However, market analyst estimates of the likely difference in cost between bail-in debt securities and equivalent existing legacy debt securities, of banks' existing funding structures and of OSFI's proposed level for the TLAC requirement suggest that the funding cost impact would likely represent less than 1% of systemically important banks' net income, and is very unlikely to represent more than 2% of net income.

Compliance with the Bail-in Issuance Regulations would likely result in systemically important banks incurring some costs (e.g. legal fees) to update the contracts and disclosure documents related to any bail-in eligible instruments they chose to issue (e.g. to meet the TLAC requirement). These costs are expected to range between $1 and $1.5 million per bank (all incurred within the first year following final publication of the regulations), for a total of $6 to $9 million across all six of the systemically important banks.

CDIC is funded through premiums assessed against its member institutions. Any of CDIC's internal costs associated with operationalizing the Bail-in Scope and Conversion Regulations and the Compensation Regulations would come from CDIC's funds, and would not be expected to result in changes to CDIC's premium rates.

OSFI is funded through assessments on the financial services industry and a user-pay program for selected services. Any costs to OSFI associated with monitoring compliance with the proposed Bail-in Issuance Regulations would be managed using existing funds, with no expected impact on industry assessments.

Implementation, enforcement and service standards

The proposed Bail-in Scope and Conversion Regulations and Bail-in Issuance Regulations would come into force 180 days after the day on which they are registered. The proposed Compensation Regulations would come into force on the day that is the later of the day on which they are registered or the day on which the amendments to the CDIC Act (those related to the compensation process for CDIC member institutions), made through the BIA 1 2016, come into force.

OSFI regulates and supervises all banks in accordance with the Bank Act and associated regulations, and would be responsible for monitoring and enforcement with respect to the proposed Bail-in Issuance Regulations.

Contact

Manuel Dussault

Senior Chief

Framework Policy

Financial Institutions Division

Financial Sector Policy Branch

Department of Finance

90 Elgin Street

Ottawa, Ontario

K1A 0G5

Email: fin.fsreg-regsf.fin@canada.ca

PROPOSED REGULATORY TEXT

Notice is given that the Governor in Council, pursuant to subsection 39.2(10) (see footnote a) of the Canada Deposit Insurance Corporation Act (see footnote b), proposes to make the annexed Bank Recapitalization (Bail-in) Conversion Regulations.

Interested persons may make representations concerning the proposed Regulations within 30 days after the date of publication of this notice. All such representations must cite the Canada Gazette, Part I, and the date of publication of this notice, and be addressed to Manuel Dussault, Senior Chief, Framework Policy Section, Financial Institutions Division, Financial Sector Policy Branch, Department of Finance, 90 Elgin Street, Ottawa, Ontario K1A 0G5 (email: fin.fsreg- regsf.fin@canada.ca).

Ottawa, June 8, 2017

Jurica Čapkun

Assistant Clerk of the Privy Council

Bank Recapitalization (Bail-in) Conversion Regulations

Interpretation

Definitions

1 The following definitions apply in these Regulations.

Act means the Canada Deposit Insurance Corporation Act. (Loi)

debt obligation has the same meaning as in section 2 of the Bank Act. (titre de créance)

non-viability contingent capital means a share or liability of a federal member institution that, by operation of the terms attached to the share or the contractual terms of the liability, may be converted into common shares of the institution as a result of a public announcement related to the institution's viability that is made by the Superintendent or Her Majesty in Right of Canada or a province. (fonds propres d'urgence en cas de non-viabilité)

subordinated indebtedness has the same meaning as in section 2 of the Bank Act. (titre secondaire)

Shares and Liabilities

Prescribed shares and liabilities

2 (1) Subject to subsections (2) to (7), the following shares and liabilities are prescribed for the purposes of subsection 39.2(2.3) of the Act:

- (a) any debt obligation, other than subordinated indebtedness, that is issued by a domestic systemically important bank and that

- (i) is perpetual, has an original or amended term to maturity of more than 400 days, has one or more explicit or embedded options that, if exercised by or on behalf of the issuer, could result in a maturity date that is more than 400 days from the date of issuance of the debt obligation or has an explicit or embedded option that, if exercised by or on behalf of the holder, could by itself result in a maturity date that is more than 400 days from the maturity date that would apply if the option were not exercised,

- (ii) is unsecured or is only partially secured at the time of issuance, and

- (iii) has been assigned a Committee on Uniform Security Identification Procedures (CUSIP) number, International Securities Identification Number (ISIN) or other similar designation that identifies a specific security in order to facilitate its trading and settlement; and

- (b) any share or subordinated indebtedness that is issued by a domestic systemically important bank and that is neither a common share nor non-viability contingent capital.

For greater certainty

(2) For greater certainty, a reference to a debt obligation or to subordinated indebtedness in this section includes a reference to any debt obligation or subordinated indebtedness that is due but remains unpaid.

Limitation

(3) A share or liability is prescribed only if

- (a) the share or liability is issued on or after the day on which these Regulations come into force; or

- (b) in the case of a liability issued before the day on which these Regulations come into force, the terms of the liability are, on or after that day, amended to increase its principal amount or to extend its term to maturity.

Partially secured

(4) If a debt obligation, other than subordinated indebtedness, is only partially secured at the time of issuance, only the portion of the principal amount and accrued and unpaid interest of the debt obligation that exceeds the value, determined at the time that the debt obligation is issued, of the collateral is a prescribed liability.

Exclusions

(5) The following, as well as any liabilities that arise from any of them, are not prescribed shares or liabilities:

- (a) any covered bond, as defined in section 21.5 of the National Housing Act;

- (b) any eligible financial contract, as defined in subsection 39.15(9) of the Act;

- (c) any structured note;

- (d) any conversion or exchange privilege that is convertible at any time into shares;

- (e) any option or right to acquire shares or any privilege referred to in paragraph (d); and

- (f) any share of a series that was created before January 1, 2013 and issued as a result of the exercise of a conversion privilege under the terms attached to another series of shares that was created prior to January 1, 2013.

Structured note

(6) For the purposes of paragraph (5)(c), a structured note is a debt obligation that

- (a) specifies that the obligation's stated term to maturity, or a payment to be made by its issuer, is determined in whole or in part by reference to an index or reference point, including

- (i) the performance or value of an entity or asset,

- (ii) the market price of a security, commodity, investment fund or financial instrument,

- (iii) an interest rate, and

- (iv) the exchange rate between two currencies; or

- (b) contains any other type of embedded derivative or similar feature.

Exceptions — structured note

(7) Despite subsection (6), the following debt obligations are not structured notes:

- (a) a debt obligation in respect of which the stated term to maturity, or a payment to be made by its issuer, is determined in whole or principally by reference to the performance of a security of that issuer; and

- (b) a debt obligation that

- (i) specifies that the return on the debt obligation is determined by a fixed or floating interest rate or a fixed spread above or below a fixed or floating interest rate, regardless of whether the return is subject to a minimum interest rate or whether the interest rate changes between fixed and floating,

- (ii) has no other terms affecting the stated term to maturity or the return on the debt obligation, with the exception of the right of the issuer to redeem the debt obligation or the right of the holder or issuer to extend its term to maturity, and

- (iii) is payable in cash.

Conditions for Conversion

Definition of conversion

3 For the purposes of sections 4 and 5, conversion means

- (a) with respect to non-viability contingent capital, conversion in accordance with its contractual terms; and

- (b) with respect to other shares and liabilities, conversion under subsection 39.2(2.3) of the Act.

Conversion amount

4 In carrying out a conversion, the Corporation must take into consideration the requirement, under subsection 485(1) of the Bank Act, for banks to maintain adequate capital.

Order of conversion

5 (1) The Corporation must use its best efforts to ensure that a prescribed share or liability is converted only if all subordinate prescribed shares and liabilities and any subordinate non-viability contingent capital have previously been converted or are converted at the same time.

Same proportion — equal rank

(2) The Corporation must use its best efforts to ensure that the converted part of the liquidation entitlement of a prescribed share, or the converted part of the principal amount and accrued and unpaid interest of a prescribed liability, is converted on a prorata basis for all prescribed shares or liabilities of equal rank that are converted during the same restructuring period.

Priority of instruments

(3) In a conversion under subsection 39.2(2.3) of the Act,

- (a) holders of prescribed shares or liabilities must receive a greater number of common shares per dollar of the converted part of the liquidation entitlement of their shares, or the converted part of the principal amount and accrued and unpaid interest of their liabilities, than holders of any subordinate prescribed shares or liabilities that are converted during the same restructuring or of any subordinate non-viability contingent capital that is converted during the same restructuring period;

- (b) holders of prescribed shares or liabilities of equal rank that are converted during the same restructuring must receive the same number of common shares per dollar of the converted part of the liquidation entitlement of their shares or the converted part of the principal amount and accrued and unpaid interest of their liabilities; and

- (c) holders of prescribed shares or liabilities must receive, if any non-viability contingent capital of equal rank to the shares or liabilities is converted during the same restructuring period, a number of common shares per dollar of the converted part of the liquidation entitlement of their shares, or the converted part of the principal amount and accrued and unpaid interest of their liabilities, that is equal to the largest number of common shares received by any holder of the non-viability contingent capital per dollar of that capital.

Ranking

(4) In this section, a share or liability of the federal member institution is

- (a) subordinate to another share or liability of the institution if, in the event that the institution is wound up, the share or liability would rank subordinate in right of payment to that other share or liability; and

- (b) equal in rank to another share or liability of the institution if, in the event that the institution is wound up, the share or liability would rank equally in right of payment to that other share or liability.

Definition of liquidation entitlement

(5) In this section, liquidation entitlement means the amount to which the holder of a share of a federal member institution is entitled to be paid, in the event that the institution is wound up, in priority to any amount to be paid to a holder of a subordinate share.

Coming into Force

180th day after registration

6 These Regulations come into force on the 180th day after the day on which they are registered.

[24-1-o]